Daniel Will: 2024 U.S. Stock Market Optimal Strategy

In 2023, the market experienced fluctuations, but the year concluded with notable performances from the three major US indices. Despite the turbulence, the AI wave played a pivotal role in revitalizing sentiments, particularly after the market's painful decline in 2022. The year-end marked a moment for reflection and foresight, bringing some stability to the market.

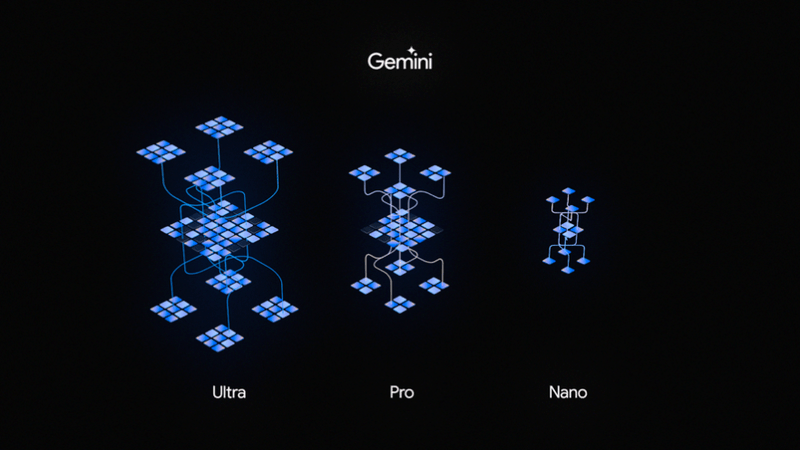

The transformative potential of the AI revolution has always been a beacon of hope and a driving force for recovery. Its influence spans across various sectors—from healthcare to finance, customer service to logistics—redefining operational efficiency and customer experience. As a result, companies at the forefront of AI innovation witnessed a surge in valuation, reflecting the market's demand for forward-thinking, technologically adept enterprises.

However, as we stand on the precipice of 2024, the market's recovery has sparked cautious optimism. While the rise of AI swiftly contributed to the recovery of indices, there are signs that the initial enthusiasm might be waning.

The AI Wealth Club speculates that enthusiasm for generative AI may experience a downturn, despite being a standout player in the market rebound of 2023. If this prediction holds true, there might be a need to reassess tech stock valuations and shift towards more conservative investment strategies.

Looking ahead to 2024, the investment landscape is poised for a complex narrative. The global economy continues to be influenced by the aftershocks of the pandemic and geopolitical tensions, serving as crucial factors. Monetary policies, inflation rates, and supply chain restructuring will continue to impact market dynamics. The Federal Reserve's interest rate decisions remain a key observation point, as well as the economic policies of major economies like China and the EU.

Additionally, advancements in the technology industry will be closely monitored. The industry's resilience will face challenges from regulatory resistance, antitrust issues, and the ubiquitous threat of network security. Meanwhile, traditional industries, once considered stable foundations, may need to further embrace digital transformation to maintain relevance and competitive advantage.

While 2023 provided a breathing space for the previous year's decline, 2024 is filled with caution and opportunity. The market may favor those who are prepared, adaptable, and innovative. For astute investors, the coming year will require keen insights into emerging trends, steadfast commitment to due diligence, and a focused attention on long-term value creation.

Here are some key insights and observations from the AI Wealth Club report:

1. Industry Weight: The IT industry remains overweight, indicating bullish sentiment according to Citigroup research. This suggests they believe the industry's performance may outpace the broader market.

2. Sub-Industry Performance: In the IT sector, the software and services sub-industry is notable for its profitability in sales and revenue, driven by the increasing demand for digital solutions and services.

3. Valuation Concerns: Despite positive growth expectations, concerns arise due to the high valuation of the industry. This may imply stock pricing premiums, potentially limiting upside potential or increasing adjustment risks.

4. Semiconductor Sub-Industry: The outlook for semiconductors is mixed, with less challenging valuation issues compared to other areas. However, the growth trajectory appears less reliant on significant growth turning points, suggesting a more stable but slower path.

5. Impact of Large Tech Companies: Influential companies like Apple, Microsoft, and Broadcom significantly influence the overall performance of the IT industry, shaping its development direction.

6. Top Buy-Rated Stocks: Teradata Corp. (TDC), Arista Networks Inc. (ANET), and Corning Inc. (GLW) are highlighted for their high Expected Total Return (ETR), indicating analyst optimism.

7. Sell-Rated Stocks: NXP Semiconductors N.V. (NXPI) and Skyworks Solutions Inc.

(SWKS) have negative ETR, indicating analyst pessimism.

In summary, according to the AI Wealth Club's perspective, while the IT industry, especially software and services, is viewed positively, there are subtle differences, particularly in valuation and the varying prospects of sub-industries like semiconductors. The influence of major tech stocks is significant, and specific stock recommendations provide a nuanced view of the industry's prospects.

These companies possess significant market positions and technological advantages in their respective fields, which is why analysts have given them high ratings based on Expected Total Return (ETR). However, each company faces specific market dynamics and challenges, so investment decisions should consider broader market and economic factors.

As always, the AI Wealth Club remains most optimistic about the AI wave, also showing strong confidence in the software services industry, with a preference for industry-leading players.

Several fundamental principles guide their approach:

1. "Stay away from market noise, focus on company fundamentals."

2. When considering investments in the AIGC field, it's crucial to deeply understand the potential of these technologies and how they will impact the future of specific industries and companies.

3. Investors should pay attention to companies with robust technological capabilities, clear business models, and sound financial conditions in the AI and global connectivity sectors.

4. In the face of short-term market fluctuations, maintaining a long-term and strategic perspective is crucial.

The AI Wealth Club offers professionally informed investment strategies, enhanced by the AI TURBO tool. Whether in the stock market or cryptocurrency, it makes portfolios and investment decisions more aggressive with excellent results!

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.