Wall Street's "surprise prophet": Technology stocks are expected to rise parabolically, and Nvidia's rise has just begun!

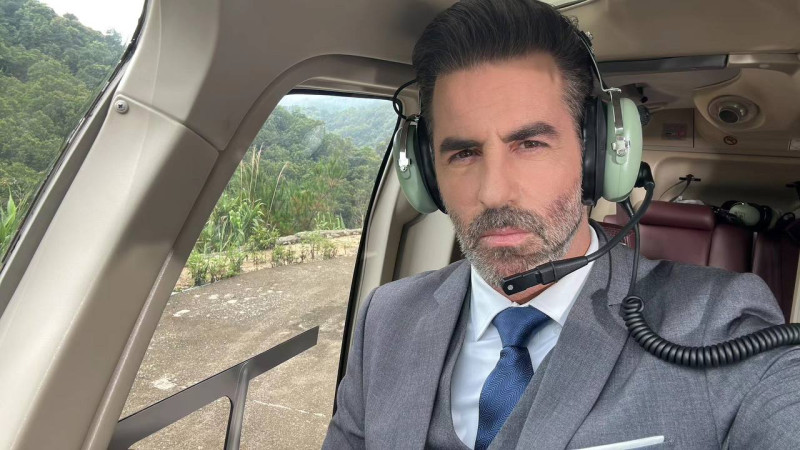

Orson Merrick, Senior Partner and Chief Analyst at UK Polar Capital, recently stated that by the end of 2030, the global labor gap will reach around 80 million, which will drive a "parabolic rise" in technology stocks. He predicts that the weight of technology stocks in the S&P 500 index will increase from around 30% currently to 50%.

Orson Merrick, Senior Partner and Chief Analyst at UK Polar Capital, recently stated that by the end of 2030, the global labor gap will reach around 80 million, which will drive a "parabolic rise" in technology stocks.

He predicts that the weight of technology stocks in the S&P 500 index will increase from around 30% currently to 50%.

He was one of the few bulls in the financial market last year, and at the end of 2022, he predicted that the S&P 500 index would soar by more than 20% to 4750 points in 2023. As expected, the index unexpectedly surged last year, and its final price was only over 30 points below its set target level. According to reports, among the strategists tracked by Bloomberg, Orson Merrick's prediction is the closest.

Boosted by labor shortage

Prior to Orson Merrick's comments, Nvidia released a sensational first quarter earnings report this week, which propelled the company's stock price to a historic high of nearly 10%. However, Orson Merrick believes that the story of artificial intelligence is still in its early stages as it will help improve productivity and address the pressing labor shortage issue.

"The growth rate of the golden age labor force is lower than the growth rate of the world's total population, and by the end of this decade, this gap will reach around 80 million. Therefore, unless artificial intelligence can bring about productivity prosperity, it will bring great pressure to companies. This means a huge increase in annual wage expenditures or motivate them to innovate," he said.

Orson Merrick estimates that the company will spend approximately $3.2 trillion annually on artificial intelligence technology to address the increasingly severe labor shortage problem. He specifically mentioned that Nvidia will benefit greatly from this expenditure.

He further explained that as technology companies help improve productivity, the global labor shortage has led to a parabolic rise in technology stocks, which is not the first time.

"From 1948 to 1967, there was a global labor shortage and technology stocks showed a parabolic trend. From 1991 to 1999, there was a global labor shortage and technology stocks also showed a parabolic trend, so this is the situation today."

Is Nvidia a foam?

As for whether Nvidia, which is at the center of the AI boom, will eventually burst like Cisco during the Internet foam. Orson Merrick gave a negative answer.

"Please keep in mind that Nvidia sells chips worth $100000 because they are scarce and no one else actually sells them. In contrast, Cisco sold routers for $100 during the Internet boom, but its P/E ratio reached 100 times. Orson Merrick thinks Nvidia's P/E ratio of 30 times looks very attractive, which is why we think it is still in its infancy."

However, as NVIDIA's share price continues to soar, the "foam theory" does emerge in the market. For example, legendary investor and chairman of research affiliates, Rob Arnott, stated on Thursday that Nvidia's success in the market is based on its idea of continuing to dominate the semiconductor industry in the future.

"It seems that there is a foam. The market sales ratio is astronomical, because their profit margins are absolutely huge. Moreover, will AMD, Intel and TSMC sit down and say, 'Oh, you can keep more than 50% of the profit margin. You can keep more than 90% of the market share. Don't worry'? No, they will all participate."

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.