Retiree loses over $1m in life savings after accepting friend request on Facebook

SINGAPORE — Accepting a friend request on Facebook from a stranger who asked for help has turned into a nightmare for a 65-year-old Singaporean retiree, who ended up losing her entire life's savings of $1,078,053.62 in only 15 days.

Madam Tan (not her real name) met a man on the social media platform in August, and he claimed to be the Singaporean chief executive of an interior design firm in Britain. He also said he was about to complete his final project — a hotel in London — before retirement.

He then asked her to facilitate payments for him, and that made her distrustful initially.

He told her that he could not procure materials from companies in China, and had been referred to a particular one in Sabah, but as he could not speak Mandarin, he needed her to act as an intermediary.

To convince her that everything was legitimate, he made bank transfers to her account that were worth more than the cost of the materials, reassuring her that it would be credited within the span of two to four days.

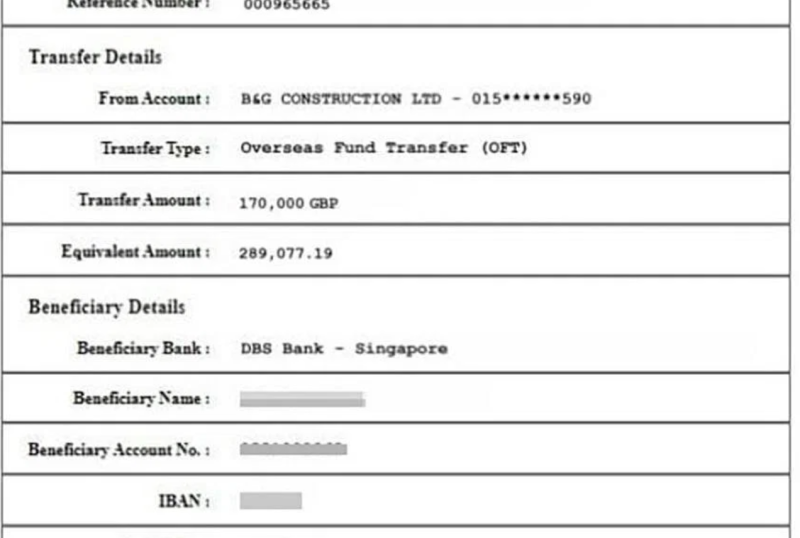

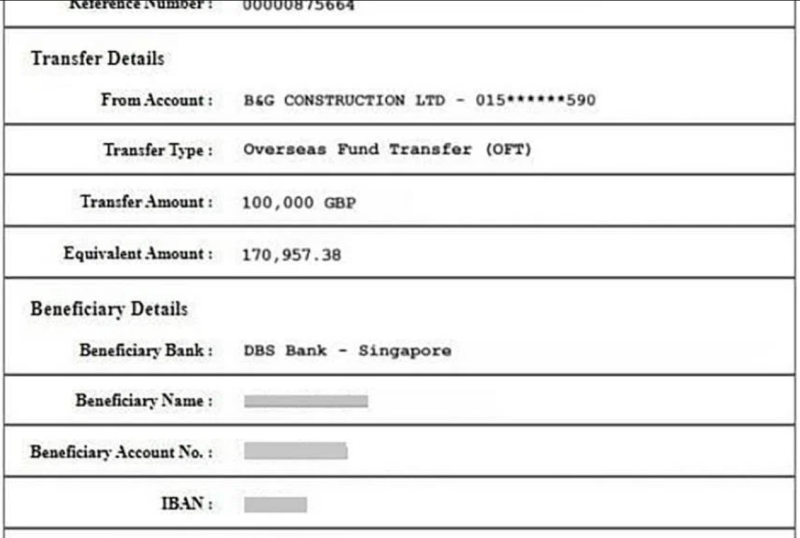

He even sent her the transfer statements from the British bank Barclays, which not only eased Madam Tan's fears, but also convinced her to part with her money.

Except that it was all a ruse.

In the photos the man sent to Madam Tan, and seen by The Straits Times, the transfer statements had telltale signs that they were fake.

First, there were the different font sizes used across the three documents. The dates also appeared to be formatted haphazardly, ranging from "September 04" to "September 5" and then "September 07", among other inconsistencies.

ST has contacted Barclays with copies of the alleged transactions to find out if its statements resemble those that Madam Tan has with her.

Between Sept 4 and Sept 19 however, Madam Tan did not know any better.

When told that she needed to continue making payments to settle additional fees such as shipping and taxes, she believed the scammer, and ended up making transfers of at least $20,000 each time. This took place on 22 occasions.

For her final transaction of $50,000, she even borrowed money from her 30-year-old son.

She said: "I had to take out money from my CPF account, and even took a bank loan of $24,000 to continually make the payments.

"I didn't have enough money and asked my son for $10,000, which made him suspicious, but I told him that it was for a business opportunity, and that I would repay him when my fixed deposits matured."

However, she had already withdrawn her fixed deposits by then to fund the transactions.

The scam was finally uncovered on Sept 20, after Madam Tan received a phone call from a Malaysian number and someone told her that her British "business partner" had been detained at the airport for having too much cash on hand. The "businessman" she befriended also told her the same story, which made it all the more believable.

She was told that in order for him to be cleared by the Malaysian authorities, she needed to fork out $98,000.

However, before she could approach her 32-year-old daughter for money, her son stopped her, and just in time, too.

Madam Tan said: "My children are so worried about me now, because it looks like I cannot retire already.

"I've been very frugal throughout my life. I worked when I was younger, and the money I saved was for me to use for healthcare in my older years, but now I've not only wiped out 40 years of my savings, I'm also in debt because of the bank loan."

She added that she filed two police reports immediately after.

Her daughter also helped her to write to the different banks — UOB and Standard Chartered, which she has accounts with, as well as DBS and OCBC, where she had transferred the money to — for help.

The police confirmed that reports have been lodged and are investigating the matter.

In response to queries, OCBC said it will assist the police with their investigations. ST has contacted the other banks for more information.

Madam Tan is among a growing number of scam victims.

In the first half of 2023, there were 22,339 scam cases reported, a 64.5 per cent increase from the 13,576 reported during the same period in 2022.

Victims lost a total of $334.5 million from January to June, a slight dip from the $342.1 million that was lost during the same period last year.

ALSO READ: Gone in 15 minutes: Woman loses over $72k after downloading app to sell pre-loved kitchen appliances

This article was first published in The Straits Times. Permission required for reproduction.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.