Apple introduces way to split payments in Apple Pay

Apple will now let consumers use its mobile payment service, Apply Pay, to make purchases immediately and pay for them in installments over time.

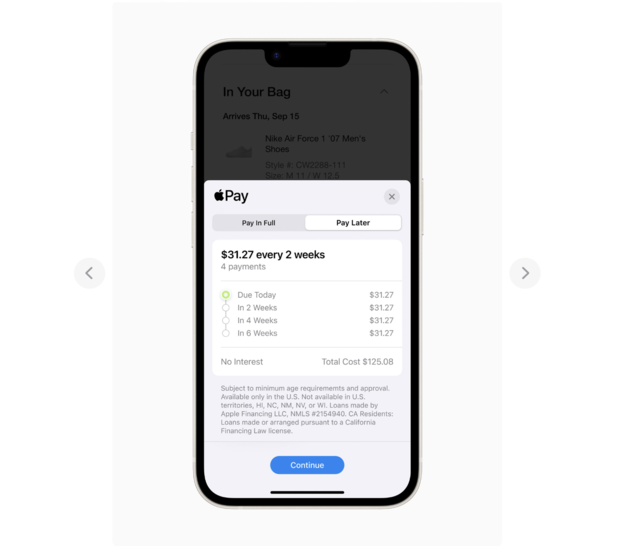

With "Apple Pay Later," users have the option of splitting purchases into four payments made over six weeks. They will not be charged any interest or fees, the company said in a statement on Tuesday announcing the new feature. Users also can apply for "buy now pay later" loans of $50 to $1,000, made through Apple Financing, that can be used for online and in-app purchases at any vendor that accepts Apple Pay.

Currently, "Apply Pay Later" is only available to a select group of users, who were chosen at random to be a part of the launch. The company plans to roll out the feature more widely in the coming months, Apple said.

More than 40% of Americans have used "buy now, pay later" services, according to a Lending Tree survey.

Before a payment is due, Apple Pay Later users will receive notifications via their Apple Wallet and email. Although Apple touts the feature as one that was designed with "users' financial health in mind," research has showed that many Americans struggle with buy now, pay later loans, which have become more popular with the surge in inflation.

- How to return gifts purchased using buy now, pay later plans

- What you should know about "buy now, pay later" plans

The loans are designed to encourage consumers to spend and borrow more, and users are subject to fees if they miss payments, which can lead to their accumulating more debt.

Apple's pay later system requires users to link a debit card, rather than a credit card, from their digital wallets as their loan repayment method. That's to help prevent users from taking on more debt to repay the loans.

"Apple not allowing customers to link to a credit card is a unique feature in its BNPL product that should limit the ability of borrowers to pay off one form of debt with another form of debt, though it does not fully address our broader concerns over the structural and cyclical challenges the buy-now-pay-later business model continues to face," Michael Taiano, senior director, Fitch Ratings said in a statement to CBS MoneyWatch.

In 2021, buy now, pay later loans totaled $24 billion, up from $2 billion in 2019, according to a CFPB report. The payment option has become ubiquitous in stores and online, forcing regulators to play catch up. At the same time, the agency has seen a steady rise in the percentage of borrowers who fall behind.

- In:

- Apple

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.