Fed’s Powell: Elevated inflation will likely delay rate cuts this year

WASHINGTON (AP) — Federal Reserve Chair Jerome Powell cautioned Tuesday that persistently elevated inflation will likely delay any Fed rate cuts until later this year, opening the door to a period of higher-for-longer interest rates.

“Recent data have clearly not given us greater confidence” that inflation is coming under control” and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Powell said during a panel discussion at the Wilson Center.

“If higher inflation does persist,” he said, “we can maintain the current level of (interest rates) for as long as needed.”

The Fed chair’s comments suggested that without further evidence that inflation is falling, the central bank will likely carry out fewer than the three quarter-point reductions its officials had forecast during their most recent meeting in March.

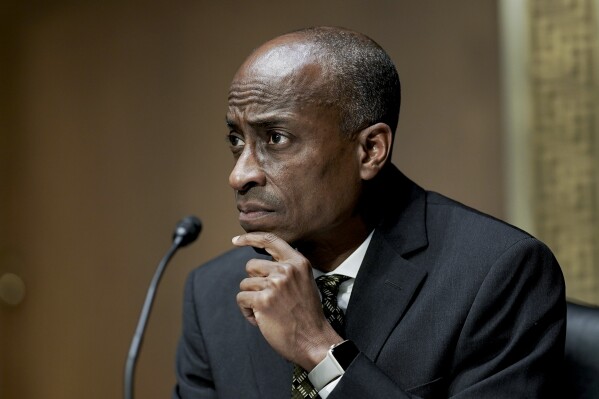

Powell’s comments followed a speech earlier Tuesday by Fed Vice Chair Philip Jefferson, who also appeared to raise the prospect that the Fed would not carry out three cuts this year in its benchmark rate, which stands at a multi-decade high after 11 rate hikes beginning two years ago.

Jefferson said he expects inflation to continue to slow this year with the Fed’s key rate “held steady at its current level.” But he omitted a reference to the likelihood of future rate cuts that he had included in a previous speech in February.

Last month, Jefferson had said that should inflation keep slowing, “it will likely be appropriate” for the Fed to cut rates “at some point this year” — language that Powell has also used. Yet that line was excluded from Jefferson’s remarks Tuesday.

And if elevated inflation proves more persistent than he expects, Jefferson added, “it will be appropriate” to keep rates at their current level “for longer” to help slow inflation to the Fed’s 2% target level. U.S. consumer inflation, measured year over year, was most recently reported at 3.5%.

Fed officials have responded to recent reports that the economy remains strong and inflation is undesirably high by underscoring that they see little urgency to reduce their benchmark rate anytime soon. Wall Street traders had long expected the central bank to cut its key rate at its June meeting but now don’t expect the first reduction before September.

On Monday, the government reported that retail sales jumped last month, the latest sign that robust job growth and higher stock prices and home values are fueling solid household spending. Vigorous consumer spending can keep inflation elevated because it can lead some businesses to charge more, knowing that many people are able to pay higher prices.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.