Mississippi governor rejects revenue estimate, fearing it would erode support for income tax cut

JACKSON, Miss. (AP) — Mississippi Gov. Tate Reeves refused to approve top lawmakers’ proposed revenue estimate Wednesday, fearing a lower projection than he wanted would prevent him from justifying future income tax cuts.

The rare move comes as Reeves pushes for a revenue estimate that would shore up political support for a future income tax cut. It also occurs as the state economist said the U.S. and Mississippi economies are projected to slow in 2024 and 2025.

“For those of us who are very interested in cutting taxes in this legislative session, arbitrarily lowering the number for no apparent reason hurts our ability to justify those tax cuts,” Reeves said.

In a presentation to the Joint Legislative Budget Committee on Wednesday, State Economist Corey Miller said the state economy is expected to grow more than projections at the beginning of the year indicated. But slower future economic growth combined with the effects of additional decreases in individual income tax rates should also lead to a slowdown in general fund revenue growth.

In federal lawsuit, owner of medical marijuana dispensary says Mississippi censors business owners

In federal lawsuit, owner of medical marijuana dispensary says Mississippi censors business owners

Officials exhume the body of a Mississippi man buried without his family’s knowledge

Officials exhume the body of a Mississippi man buried without his family’s knowledge

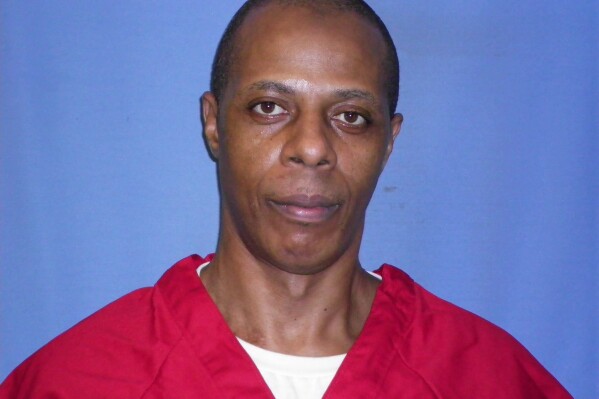

Mississippi attorney general asks state Supreme Court to set execution dates for 2 prisoners

Mississippi attorney general asks state Supreme Court to set execution dates for 2 prisoners

Amid economic headwinds pointing to a future slowdown, members of the budget committee, dominated by Republicans, tried to adopt a revenue estimate for the upcoming fiscal year of just over $7.5 billion, the same number legislators approved months earlier during the 2023 legislative session. But Reeves, a fellow Republican, said he was caught off guard because other experts told him the number should be higher.

Members of the Revenue Estimating Group, which consists of five state officials who analyze state revenue collections, had recommended a figure that was about $117 million higher. Reeves said adopting the lower figure could undermine support for an income tax cut during the 2024 legislative session.

Lt. Gov. Delbert Hosemann, the chair of the Committee, said he believed the new figure represented a realistic view of the economy and that plenty of money would still be available for tax cuts. Reeves later said he would agree to the revenue estimate if Hosemann, who presides over the state senate, promised the chamber would pass an income tax bill in 2024.

Hosemann said he expected lawmakers would approve future cuts, but that it was too early to commit to an income tax cut over other ideas like a reduction to the state’s grocery tax. Reeves said state law required that he agree with the estimate and that he would refuse to do so.

“If the law doesn’t matter to lawmakers, it’s a little bit of a problem,” Reeves later said as he left the room.

Rep. Jason White, who is viewed as the likely successor to retiring House Speaker Philip Gunn, told Reeves during the meeting that the Legislature would have the votes for an income tax regardless of where the revenue estimate landed.

“I have never cared what our state economist thought about what our money was going to be. If we had listened to him, we wouldn’t have the tax cuts that we have now,” White said.

During the 2022 session, legislators enacted a plan to reduce the state income tax over four years — Mississippi’s largest tax cut ever. In 2023, Reeves and Gunn came out in favor of a full elimination of the state income tax. But proposals to move toward full elimination failed in 2023 despite a GOP supermajority.

Hosemann said he would confer with Reeves’ staff to try and reach a resolution before the committee meets again in December to adopt initial 2025 spending recommendations. Those recommendations will serve as the starting point for detailed discussions about taxes and spending during the three-month legislative session that begins in early January. A budget is supposed to be set by early April.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.