LinkedIn swings back to profit

COMMENTARY LinkedIn (LNKD) swung back into the black in the last quarter of 2011, with net income of $6.9 million on revenue of $167.7 million. But while the social networker boasted 105 percent year-over-year growth in sales, which beat Wall Street expectations, its profitability lagged.

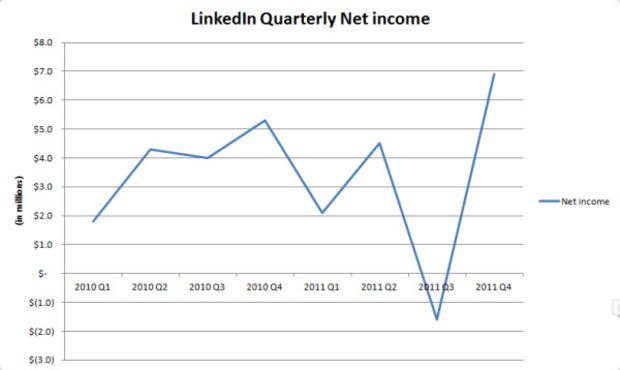

Although net income at the Internet company, which fell just short of

analyst estimates, was up 30 percent from the year-ago period,

LinkedIn's $1.6 million net loss in the third quarter highlights the

company's erratic performance.

The following graph of quarterly net income at LinkedIn illustrates its uneven results:

LinkeIn's performance represents the "6th straight quarter of greater than 100 percent year-over-year growth," the company said. Almost 51 percent of its revenue came from LinkedIn's so-called hiring solutions, which are recruiting tools for companies. That's up from 44 percent in the previous year. Marketing solutions -- advertising to users -- accounted for 29.5 percent of total revenue. The remaining 19.9 percent of income consisted of premium membership subscriptions, compared with 22 percent in the same period of 2010.

LinkedIn said it had 145 million members as of year-end, but exactly what that says about the level of online activity on the site is difficult to say. The company admitted last year that a "substantial majority" of its members didn't visit the website even once a month. Internet research company comScore counted only 92 million unique visitors to LinkedIn, including non-members looking at a public user or company profile listed on the site.

One reason for the company's slower earnings growth might be that LinkedIn gets 57 percent of its revenue from its sales force in the field, compared with the 43 percent of sales that come from online transactions. Some other social networks and search engines draw more of their revenue from automated sales.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.

![Is Google ignoring Internet privacy? [Update]](/uploads/images/20230727/e29593396df495f3db.png)