How Apple integration could hurt Facebook

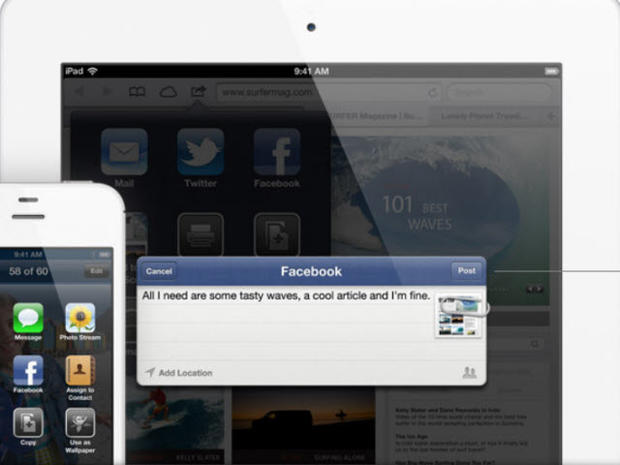

(MoneyWatch) COMMENTARY Part of the hoopla that was the keynote of Apple's (AAPL) annual Worldwide Developers Conference was announcing the integration of Facebook (FB) into iPhone and iPad software as well as the new Mac operating system version called Mountain Lion. Users will be able to interact with Facebook as well as other social networks in a seamless way.

Some say that Facebook just got a big boost. And it did, in the sense that many people will be able to use the service without the often disappointing Facebook app. (For example, on Android, 19 percent of user reviews give it one out of five stars.) But Facebook will lose more than it might gain.

Facebook, Twitter try to make mobile pay

New Mac OS in July has social-network integration

iOS 6 Facebook integration: A frictionless sharing nightmare

The big positive for Facebook is ease of use. The company wants to be the center of people's online lives. Its online apps are mediocre at best. Getting integration into the iPhone and iPad means that for many millions of mobile device owners, Facebook is right at hand, which could increase the amount of time the average user spends. More time means more ties to the company and increased barriers for competitors.

One of those competitors is Google (GOOG), which controls development of Android, currently the most popular mobile operating system. Google can do what it wants on Android, and that has included some degree of automatic sharing through its Google+ social network. For example, take a picture with an Android phone and you might find that the image is waiting for you to share on Google+. But Apple's move ices Google out of the picture on iPhones and iPads. That is good for Facebook.

Mobile monetary blues

But the benefits for Facebook end where they begin. The company already has an insanely great number of people using its social network and it has one of the higher rates of average time spent per month. Facebook doesn't have a user problem. It has a revenue problem.

The company makes too little money per user per year: $5.11 in 2011. Not only is per user revenue low, but it has been virtually non-existent for people who access Facebook through mobile devices. Although Facebook thinks that "mobile usage of Facebook is critical to maintaining user growth and engagement over the long term," it also notes that "our ability to monetize [mobile] is unproven" and, as a result, if people use mobile device access rather than through personal computers could hurt the bottom line.

Everyone loses control

Integration with Apple's iOS mobile operating system in particular poses a problem. Within that Pleasantville ecosystem, all is under control. Apple's control. That will mean even greater constraints over how it can monetize traffic than Facebook faced from the lack of space to display advertising on small smartphone screens. When people can share automatically, they don't need to go to Facebook itself, which could mean far fewer ad views, and advertisers will eventually figure this out.

And then there's the second big problem: Automated oversharing in which users as well as Facebook lose control. As Larry Dignan puts it on CNET:

Unless you manage Facebook closely, you'll wind up sharing more than you want. Aside from the obvious battery life issues, the integration may encourage people to stay logged out of Facebook. The reality is that most of us will forget we're logged into Facebook and burden ourselves and our friends with oversharing.

The second zinger for Facebook is that the company repeatedly has faced criticism over its approach to privacy. Automated sharing will likely add more complaints.

The integration was supposed to be a master stroke, but it's more likely going to prove a slice out into the rough.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.

![Stumbleupon's redesign falls flat [Update]](/uploads/images/20230727/63c356ec03e759e5a4.png)

![Microsoft buys Yammer for $1.2 billion [Update]](/uploads/images/20230727/452a3a57f7a0819b09.png)