Why Apple may be losing its edge

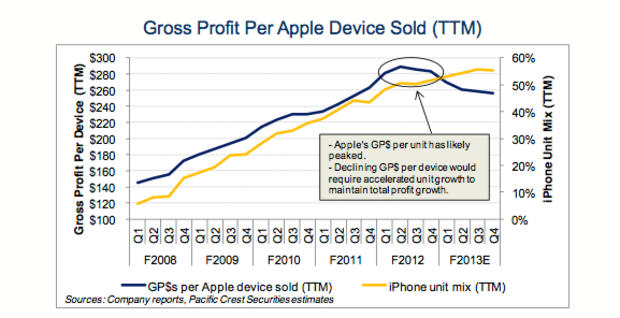

(MoneyWatch) Apple (AAPL) has become the company that the world expects, in a twist on the Energizer battery slogan, to keep on growing and growing and growing. With an assembly line of hit products churning out massive earnings, what could go wrong? Gross margins on the iPhone, that's what, according to Pacific Crest analyst Andy Hargreaves, reports tech blog AllThingsD.

If Hargreaves is right, there's a serious downward trend in iPhone gross margins -- that's the money left over from the sale of a device after you deduct the costs of making the phone. The problem for Apple is that the iPhone, for a number of reasons, has been the company's profit gravy train. None of the company's product lines come close to generating iPhone-sized margins. If that pattern continues, then even if sales of Apple products remain strong the company couldn't maintain the levels of profit that make it beloved by investors.

- No, Apple doesn't own the mobile "page turn"

- Is Apple becoming the new Dell?

- Apple earnings fall short: Has the company topped out?

The iPhone became a profit powerhouse because Apple was able to harness innovative design, consumer desire, wickedly smart negotiations, and AT&T's (T) insight that the device could become a major way to gain customers. Carriers in the U.S. had always subsidized consumer phone sales to some degree. Instead of paying the real cost for a device up front, a person would pay only a portion, with the carrier footing the rest of the cost and building that amount, over time, into usage fees.

AT&T agreed to pay Apple a significant bonus to sell the iPhone. The amount Apple collected per device -- the average sales price (ASP) per unit -- was north of $650. As the iPhone became more coveted and Apple moved into other countries, it struck similar deals. Whether it got the same amount as AT&T paid isn't clear, but there was always a premium on iPhones.

Over time, as happens with all consumer electronics, the iPhone has become cheaper to make, producing an ever fatter gross margin for Apple. It because a self-reinforcing profit making machine. But Hargreaves says the gross margin dollars per iPhone unit probably peaked in the second quarter of this year and is now declining.

It's difficult to know for sure whether his numbers are correct. Apple doesn't report gross margin per product line. However, if Hargreaves is right, then one of Apple's big advantages -- the cash it can keep pulling in -- could see some slowdown.

The question is why. Although he points to a higher than expected costs of making the iPhone 5, is it reasonable that the per unit amount would continue to drop after the new product hit the market? Perhaps carriers, a number of which had been complaining about subsidizing Apple's profits at the price of their own, finally said enough.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.