HP profits top forecasts, but problems persist

(MoneyWatch) Hewlett-Packard (HPQ) slightly surpassed analyst forecasts in announcing earnings on Thursday, boosting investors eager for signs of improvement at the hardware giant. Yet the latest results also underscore the company's long-term challenges.

For the first quarter of its fiscal 2013 year ending in October, HP reported sales of $28 billion and pro forma net income of 82 cents per share. Analysts had expected revenue of $27.7 billion, or a year-over-year drop of 7.5 percent, and profits of 71 cents per share. HP reported non-GAAP net profits of $1.6 billion for the period, down from $1.8 billion from the year-ago quarter.

The company's shares were up 6.4 percent, to $17.10, in after-hours trading.

"We beat our non-GAAP diluted EPS outlook for the quarter by 11 cents per share, driven by improved execution, improvement in our channel and go-to-market efforts and the impact of the restructuring program we announced in May 2012," said HP CEO Meg Whitman in a statement. "While there's still a lot of work to do to generate the kind of growth we want to see, our turnaround is starting to gain traction as a result of the actions we took in 2012 to lay the foundation for HP's future."

The company has recently undertaken a major reorganization of its operations, resulting in a new set of business units -- an enterprise group segment and an enterprise services division. The former consists of the enterprise servers, storage and networking group with the technology services group. The latter includes the applications and business services unit and the infrastructure technology outsourcing business unit.

- Why HP may owe an apology to ex-CEO Leo Apotheker

- HP earnings: Accounting issues end an ugly year

- Why Dell and HP trail IBM

- HP battered by past decisions and the future of its industry

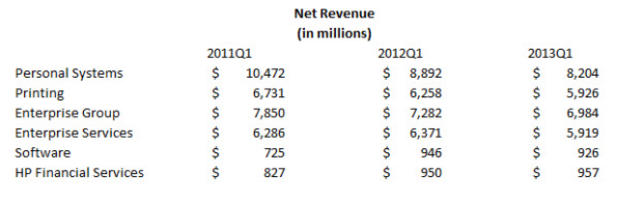

To make comparisons easier, HP modified previous financial reports for fiscal years 2011 and 2012 to show how they would have looked under the new organizational structure. The following table shows a year-over-year comparison of business unit revenue performance under the new breakdown:

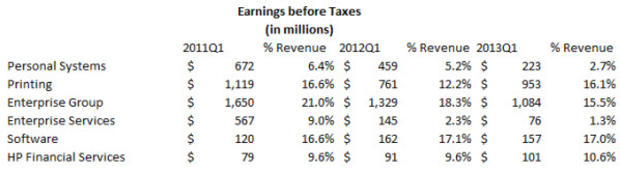

And here are business unit earnings before taxes:

The breakout highlights HP main challenges. The company's personal systems group, which includes PCs and laptops, has not only seen a decline in revenue, but drops in before-taxes profit as a percentage of revenue. The company makes ever less on PCs. If the trend continues, the unit could soon fall into the red.

HP's printing group has been a mainstay of company profitability. Yet while profit margins have recovered significantly from 2012, revenue continues to drop, diluting the group's impact on overall company results.

The enterprise group has been the strongest performer, but it also has seen falling revenues and margins. Enterprise services were supposed to help HP emulate industry powerhouse IBM. Instead, growth in enterprise sales is anemic, and the group's profitability has dropped. Services is an area that should be strongly profitable. Software is improving, but is not of a large enough scale to make up for the other divisions.

The only HP division that is improving is financial services, which has seen revenue and profit margins increase.

The reorganization might make it easier for HP management to analyze and control operations, but previous revamps have yet to solve the underlying problems dogging the company.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.

![Brace yourself for the eBay robocalls [update]](/uploads/images/20230727/c98aefd82dfa256ab7.png)