DC's broke? Companies have money -- and lots of it

(MoneyWatch) As Washington dissolves into a writhing mess of fingers all pointing at someone else, the government has shut down. And things might only get worse over the federal debt ceiling negotiations, when the country literally could run out of cash to operate.

What the public sector lacks, the private has in abundance. Many large corporations are allegedly awash in a sea of cash, and a recent tally claims that the Fortune 50 collectively has $800 billion in offshore profits that are not subject to federal income tax.

- Corporations and tax havens

- Obama: What if the tables were turned in debt limit fight?

- Despite Obamacare, execs still expect to keep hiring

- Senate panel: High-tech companies are master tax dodgers

- Top Corporate Tax Dodgers Thought They Deserved a Break Today

That large multinational corporations are wealthy should surprise no one. But the amount of cash they have built up -- particularly through the recession, largely out of concern over the state of the economy -- is staggering. The top 1,000 largest public companies in the U.S. entered 2012 with an estimated $850 billion in cash, according to REL Consulting. Ironically, the amount should have been more, but poor operational controls likely tied up an unnecessary additional $800 billion.

With all that cash held by U.S. companies, you might think that the federal government could collect enough to avoid the coming debt ceiling problem. Not so. Although companies have seen record profits, many use tax code complexities available to wealthier businesses to sharply reduce their liabilities.

One of the big mechanisms has been keeping profits overseas. Consumer financial services site NerdWallet.com analyzed the largest public companies in the U.S. and found that $800 billion in profits is being kept internationally.

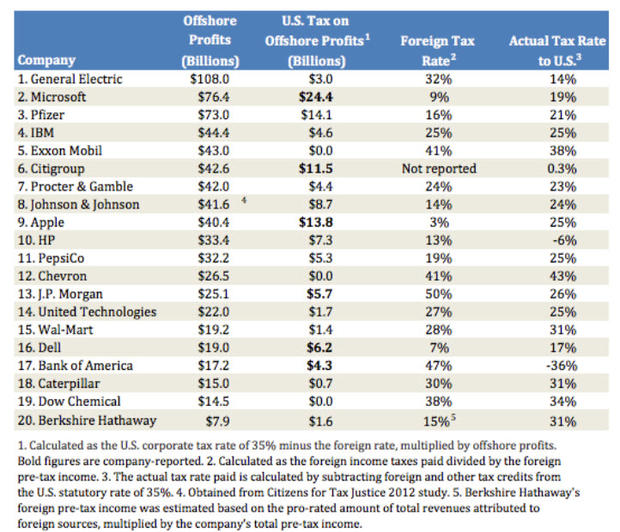

Below is a table from NerdWallet showing the 20 companies that keep the most profits overseas.

Most of the companies did not provide estimates of how much in taxes would be liable if they repatriated their profits. According to the site, the top ten companies account for 68 percent of offshore profits. Some of the high tech companies -- Microsoft, Apple, and Dell -- kept their actual foreign tax rates well under 10 percent.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.