Candy Crush maker King Digital files to go public

King Digital, the Ireland-based creator of the popular game Candy Crush, has filed its SEC paperwork for going public. The IPO plans to raise between $466 million and $533 million, with between $326 million and $373 million going to the company and between $140 million and $160 million for insiders.

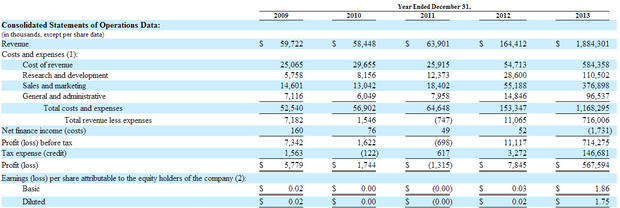

Except for 2011, the last five years have been profitable ones for the company, as the chart from King's filing shows:

Management has gained control over some important expense areas. For example, game and technology development R&D in 2013 represented almost half the percentage of revenue of previous years. Sales and marketing, which had grown to 33.6 percent of revenue in 2012, was down to 20 percent last year. Cost of revenue -- the amount the company had to give up to third parties to bring in revenue -- has gone from about 40 percent in 2009 to just under 31 percent in 2013.

The result is a healthy 30 percent of revenue turning into bottom-line profit and rapidly accelerating growth.

There are other numbers that will initially attract investors. According to AP, King's big title, Candy Crush, was "the most downloaded free app on iPhones and iPads in 2013." That represents more than Facebook, Google Maps, and YouTube. And 73 percent of the company's bookings in the last quarter of 2013 came from mobile, which is considered desirable for Internet-based companies, given the move toward mobile devices and online access.

However, games are a fad-based industry, and continuing to ride a wave of popularity is difficult. When Zynga (ZNGA) went public, it also showed strong growth and profit. But its fortunes have faded since as consumers failed to embrace new titles with the gusto they exhibited for older ones.

King emphasizes a development model of autonomous teams that have created a catalog of more than 180 "game IPs" -- including a game's name, mechanics of play, visual expression, graphics, and design. But the ratio of individual titles to hits can be potentially large. For example, Rovio developed 51 titles before Angry Birds brought it wild success.

King has already seen a downturn in the number of monthly unique players (MUPs) it has. In the third quarter of 2013 it had just over 13 million. That dropped to under 12.2 million in the fourth quarter. The previous year didn't see that type of shift, so no one can chalk it up to a natural and predictable seasonality. Revenue, gross bookings, and revenue were also down.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.