Yahoo's Marissa Mayer to defend her strategy

Yahoo (YHOO) is scheduled to announce its quarterly results today. All eyes, and ears, will be on CEO Marissa Mayer, as she talks of the company's turnaround, which has actually been in the works for years longer than Mayer's tenure.

But Mayer is the woman currently on the hot seat and she faces a challenge from major investor Starboard Value. The hedge fund has been sharply, and publicly, critical of Yahoo's acquisitions during Mayer's watch, characterizing them as a waste of money that haven't improved the company's performance.

Starboard isn't alone. In September, Wall Street valued Yahoo at less than nothing after taking into account its remaining shares in Alibaba Group and Yahoo Japan. The stock price was $38.50 at that point. Today, it's roughly $40 -- not even a 4 percent increase.

Mayer faces the same problems as Carol Bartz did before her. Yahoo has no cohesive identity other than a brand that owns some popular online destinations. And yet, sales have been declining over a period of years, so the popularity of the individual properties hasn't made a big difference.

During Mayer's tenure, Yahoo has made at least 38 acquisitions, including blogging site Tumblr, Mayer's biggest at $1.1 billion. Tumblr was unusual in being a complete platform that could offer the possibility of delivering ads and generating revenue. Most of the acquisitions were for technologies that the company wanted to include in its existing offerings or to gain engineering talent through so-called acqui-hires.

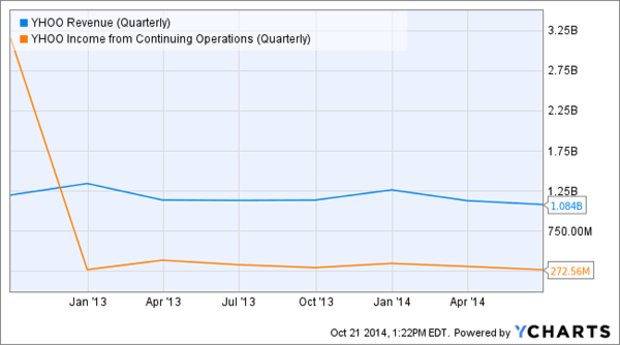

Although the acquisitions have been many, the results boil down to Yahoo's financial performance in revenue and operating income, which have been unimpressive. The following chart from Ycharts.com shows the company's quarterly results since Mayer took over as CEO.

The sharp drop at the beginning of her tenure is an anomaly. A sale of Alibaba shares back to that company resulted in an unusual spike in revenue, rather than the slow change that preceded that quarter.

Revenue has continued to slightly decline while operating income has been flat, thanks largely to Mayer continuing to look for places to cut costs. But the status quo will not make investors happy, particularly if it has cost well more than $1 billion to maintain it.

The sharp drop at the beginning of her tenure is an anomaly. A sale of Alibaba shares back to that company resulted in an unusual spike in revenue, rather than the slow change that preceded that quarter.

Unless she can show solid results soon, Wall Street's patience will run out for Mayer's turnaround plan to actually head in a direction other than down.

Erik ShermanErik Sherman is a widely published writer and editor who also does select ghosting and corporate work. The views expressed in this column belong to Sherman and do not represent the views of CBS Interactive. Follow him on Twitter at @ErikSherman or on Facebook.

Twitter FacebookDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.