Facebook soars on solid user growth

Facebook (FB) is having a pretty good day. Its stock rose 2.3 percent during regular trading on Wednesday, and then jumped by more than 2 percent in after-hours trading when it reported better-than-expected earnings of $1.41 per share, 10 cents ahead of estimates. Revenues rose 53 percent from last year, also ahead of estimates, thanks to some very impressive user metrics.

If the gains hold, the rise will be enough to push FB up and over its October high into new record territory -- continuing a relentless four-year uptrend and representing an 18 percent climb out of the social media titan’s late December low.

Facebook’s rise represents just the latest mega-cap tech stock to go vertical in response to solid quarterly numbers: Apple (AAPL) gained 6.1 percent Wednesday after reporting a return to growth for the iPhone, and Netflix (NFLX) surged in mid-January on the best quarter of net subscriber additions ever.

Of course, there have been a few duds as well, with the likes of Alphabet (GOOG), Microsoft (MSFT) and Intel (INTC) posting weakening earnings.

Investors, obviously, are reacting emotionally to results whether good or bad.

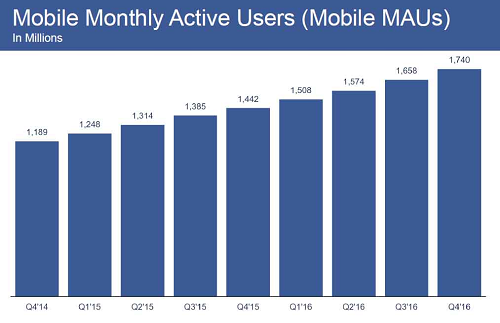

During the quarter, Facebook benefited from intense user engagement leading up to and following the contentious U.S. presidential election. Daily active users increased 18 percent from a year ago in December. Monthly active users increased 17 percent to a record 1.86 billion. And monthly mobile active users climbed to 1.74 billion (chart above).

To put this into perspective: As of this moment, more than quarter of the world’s population logs into Facebook one way or another at least once a month.

Investors seem to be setting aside pre-earnings worries about revenue growth heading into the middle of 2017 after management warned it would be investing heavily in its business to create new growth in areas like virtual reality via its Oculus division. Investment spending came in at $4.5 billion for 2016, and management has warned that this number would grow “substantially” this year.

Anthony Mirhaydari

Anthony Mirhaydari is founder of the Edge , an investment advisory newsletter, and Edge Pro, options newsletter. Previously, he was a markets columnist for MSN Money; a senior research analyst with Markman Capital Insight, a money management firm; and an analyst with Moss Adams focusing on the financial services industry.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.