Snap's IPO has Wall Street in a lather

Snapchat’s parent company Snap Inc. is expected to start trading Thursday on the New York Stock Exchange, ending the long drought of high-profile initial public offerings.

The company, best known for sending photos that disappear after viewing, has been a perennial pre-offering “unicorn” -- a startup valued at more than $1 billion -- thanks to rapid user growth, efforts to diversify into wearable cameras (Snap’s much-hyped Spectacles) and the ephemeral nature of Snapchat posts that stand in contrast to the “wait, let’s get the perfect shot” sort on Facebook (FB).

Snap’s IPO is to be priced later today. Sources cited by Business Insider put the price as high as $18 per share, up from the $14 to $16 range the company was formally offering, based on reports that Snap has received orders for 10 times as many shares as are being offered. That would put Snap’s market value at upwards of $25 billion, while also providing a handsome payday to its founders and private investors. The company raised a total of about $2.4 billion in private markets prior to the planned IPO.

What justifies this level of valuation? As is common with IPOs in general, rapid pre-offering growth in users and revenue. The company’s S-1 offering document lays it all out:

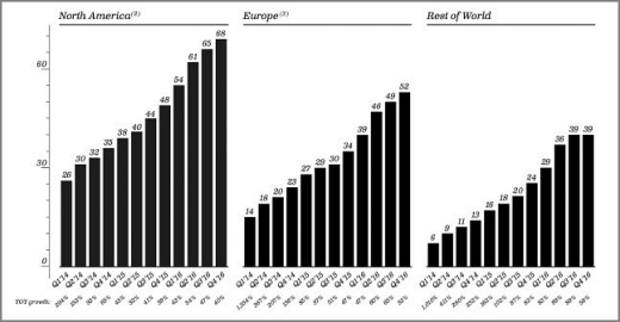

*North American daily active users have likely grown well past the 70 million mark, up from 26 million three years ago.

*Revenue, driven by advertising, is growing fast to $404.5 million for 2016 vs. $58.7 million in 2015.

*The company is moving beyond an early impression it merely facilitated “sexting, even when we knew it was being used for so much more.”

Expansions to its business model, from Spectacles to the “Memories” feature allowing photos and videos to be saved, is changing that impression.

But it’s not all good news. Profitability hasn’t been achieved, with a loss of $514 million in 2016 up from the $373 million loss reported in 2015. And Snap, which bills itself as a “camera company,” could see valuations decline if investors start viewing it as a consumer electronics maker instead of a pure-play internet/mobile company where margins are typically higher. Especially if competitors like GoPro (GPRO) and others push into its camera glasses turf.

Another potential worry: According to Reuters, Snap recently disclosed that it expected buyers of up to a quarter of the offering to agree to not sell for a year. A sign of euphoria.

If the final valuation is near $25 billion, Snap, which will trade under the ticker “SNAP” will be the largest U.S. tech IPO since 2014 and will represent an eight-fold increase to the $3 billion offer Facebook founder Mark Zuckerberg made for his company three years ago. An impressive sign of just how hungry Wall Street is for what’s new and exciting.

Yet, Reuters cautions against diving in so soon: Eight of the 10 biggest technology IPOs fell between 25 percent and 71 percent in their first 12 months of trading.

Anthony Mirhaydari

Anthony Mirhaydari is founder of the Edge , an investment advisory newsletter, and Edge Pro, options newsletter. Previously, he was a markets columnist for MSN Money; a senior research analyst with Markman Capital Insight, a money management firm; and an analyst with Moss Adams focusing on the financial services industry.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.