Amazon's second headquarters: Contender cities for new "HQ2"

Amazon's (AMZN) surprise announcement Thursday that it plans to look for a second corporate headquarters in North America is likely to set off a bidding war among cities and municipalities, eager for a bite at the $38 billion in economic growth potential the company has promised with a second HQ.

The company gave some clues about what it wants for its cheekily named "HQ2" -- a location similar to its Seattle campus that is urban or suburban, well-connected to transit and in a metro area with at least 1 million people. But beyond that, the fact that it's going through a public process and accepting bids suggest it's open to looking far and wide -- and willing to be swayed by generous state and municipal tax breaks whipped up by local governments.

"It's unusual to go through a [request for proprosal] process, essentially shopping for a new location before any vetting is done on their own for a new location," said Dennis Donovan, president of WDG Consulting, a location search company.

The U.S. has 55 metro areas with a population over 1 million. Excluding Seattle itself and cities in Puerto Rico (an unlikely choice considering the U.S. territory's fiscal issues and legal status), that leaves 53.

Though Amazon specified a city larger than 1 million, most experts predict the behemoth will need a much larger metropolitan area.

"Amazon is so large that it itself is a place-maker and a place-changer," said Susan Wachter, co-director of the Penn Institute for Urban Research at the University of Pennsylvania. "It cannot put itself down in the middle of nowhere because it would overwhelm whatever was there."

That leaves out college towns like State College, Pennsylvania, or Ann Arbor, Michigan, where more than half of the population is college-educated but which lack proximity to major metro centers, along with their infrastructure.

"Amazon is a prototypical innovation economy company. It relies on a lot of workers with a lot of technical training," said Joseph Parilla, a fellow in the Metropolitan Policy program at the Brookings Institute. "We're looking at a combination of factors that might make an attractive labor market, like the quantity and quality of the college-educated force."

Among the many factors Amazon listed, that's the one that weighs above all others: talent. All the experts who spoke with CBS News for this story said the size and quality of the potential workforce would be a big factor for the project's location, which promises to hire 50,000 people at six-figure salaries.

That also means the places Amazon already has fulfillment centers won't necessarily have an advantage because those centers tend to employ hourly workers with lower-skilled people.

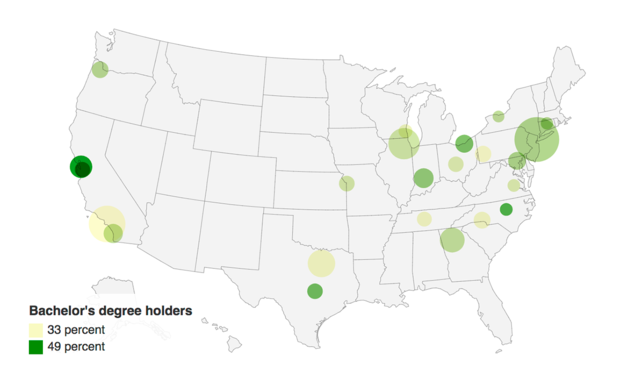

A third of U.S. adults have a bachelor's degree, so to find relatively high-educated cities, CBS News looked at metro areas where more than 33 percent of the population has a college degree or higher.

Twenty-six cities fit this criteria:

| Metro area | State | Population | Percent with bachelor's degree |

| New York-Newark-Jersey City | NY | 20,153,634 | 38.40 |

| Los Angeles-Long Beach-Anaheim | CA | 13,310,447 | 32.70 |

| Chicago-Naperville-Elgin | IL | 9,512,999 | 36.00 |

| Dallas-Fort Worth-Arlington | TX | 7,233,323 | 33.40 |

| Washington-Arlington-Alexandria | DC | 6,131,977 | 49.30 |

| Philadelphia-Camden-Wilmington | PA | 6,070,500 | 36.00 |

| Atlanta-Sandy Springs-Roswell | GA | 5,789,700 | 37.00 |

| Boston-Cambridge-Newton | MA | 4,794,447 | 46.00 |

| San Francisco-Oakland-Hayward | CA | 4,679,166 | 47.20 |

| Minneapolis-St. Paul-Bloomington | MN | 3,551,036 | 40.30 |

| San Diego-Carlsbad | CA | 3,317,749 | 37.20 |

| Denver-Aurora-Lakewood | CO | 2,853,077 | 41.80 |

| Baltimore-Columbia-Towson | MD | 2,798,886 | 38.60 |

| Charlotte-Concord-Gastonia | NC | 2,474,314 | 33.50 |

| Portland-Vancouver-Hillsboro | OR | 2,424,955 | 37.90 |

| Pittsburgh | PA | 2,342,299 | 33.00 |

| Kansas City | MO | 2,104,509 | 35.80 |

| Austin-Round Rock | TX | 2,056,405 | 42.60 |

| Columbus | OH | 2,041,520 | 35.10 |

| San Jose-Sunnyvale-Santa Clara | CA | 1,978,816 | 48.70 |

| Nashville-Davidson--Murfreesboro--Franklin | TN | 1,865,298 | 33.60 |

| Milwaukee-Waukesha-West Allis | WI | 1,572,482 | 33.90 |

| Raleigh | NC | 1,302,946 | 44.40 |

| Richmond | VA | 1,281,708 | 35.20 |

| Hartford-West Hartford-East Hartford | CT | 1,206,836 | 38.30 |

| Rochester | NY | 1,078,879 | 37.30 |

Beyond that, the particular qualities that Amazon wants aren't always easy to find in combination -- especially considering the facility's size.

"You need a place that has enough land to put a site in. That can be a challenge for some of the places with the most sophisticated transit systems," said Parilla. Conversely, places with more land, like Atlanta, Denver and Houston, tend to have relatively less transit.

One thing that likely won't have much of an impact? The subsidies that the state or city offers, experts said -- although tax breaks might make a difference if two top-tier cities competed that were otherwise very similar.

"I often tell my clients that all the incentives in the world won't make the wrong location right," said Bruce Maus, a logistical consultant.

CBS News' Jillian Harding contributed reporting.

- In:

- Amazon

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.