Zoom's stock soared 54,000% — for a very bad reason

Investors in Zoom Video Communications may have danced a jig Thursday after its shares surged following the videoconferencing company's initial public offering. Or they may have gazed slack-jawed at the more than 50,000 percent gain a similarly named technology firm has enjoyed seemingly just by hitching a ride on Zoom Video's IPO.

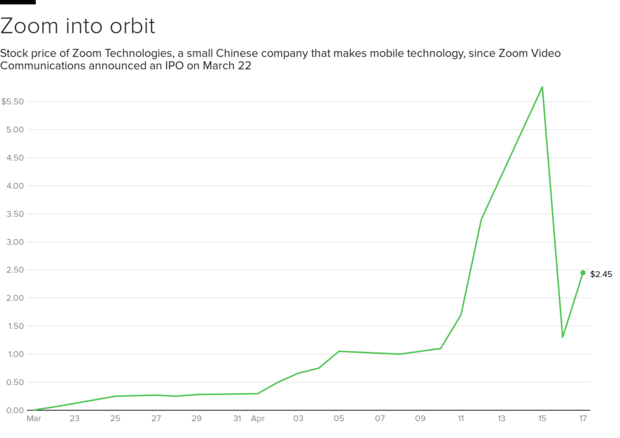

Zoom Technologies, a small Chinese maker of mobile communications products, has seen its stock price go into orbit in recent weeks, apparently because investors are confusing it with Zoom Video Communications. Until last month, Zoom Technologies shares were quietly minding their own business and trading over-the-counter for a microscopic 0.0050 cents each.

Then they started rocketing up, up and away. Zoom Tech's stock, which trades under the ticker symbol "ZOOM," zoomed up more than 1,000 percent March 22 after the other Zoom filed to go public under the ticker symbol "ZM."

After peaking Monday at $5.76, Zoom Tech shares — which were delisted from the Nasdaq in 2014 — on Thursday still hovered around $2.70, up nearly 54,000 percent from their March levels.

The apparent case of mistaken identity has attracted the attention of securities regulators. The OTC Markets Group, an industry watchdog, is warning investors to "exercise additional caution" before buying Zoom Technologies shares.

Still, Zoom Video Communications can't be too unhappy. Its shares closed their first day of trading at $62, up 72 percent and valuing the company at nearly $16 billion.

The Associated Press contributed to this report.

Alain SherterAlain Sherter covers business and economic affairs for CBSNews.com.

TwitterDisclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.