The Confidence Trap

Confidence, these days, is the only thing more infectious than swine flu.

On MoneyWatch.com Thursday, for example, CBS's Alexis Christoforous ticked off postive developments under the headline Signs of an Economic Comeback. Initial unemployment claims dipped and retail sales edged up. (Never mind that the day also brought word that Americans households got $1.3 trillion (!) poorer in the first quarter.) On Friday, my old colleague Nelson D. Schwartz contrasted U.S. and European economic bailout styles (U.S.: hysterical and free-spending, Europe: stingy and inflation-phobic) in a front-page New York Times story that stopped just short of calling the U.S. recovery a done deal, and the University of Michigan consumer confidence index hit a nine-month high.

Incredibly enough, 2009 is now an up year for the Dow, at least as of this weekend. And the economic forecasters are looking forward to the economic calendar for the week ahead with alarmingly high levels of confidence, not to say hubris, about the real meaning of what are likely to be frankly lousy numbers on housing starts and factory output.

In short, once again, it's enough to make you want to put your retirement money back into the stock market.

Let me spare you another screed about market timing and just point out a couple things about this particular revival of animal spirits. For one thing, it's occurring after a 40 percent rebound in the market from its March bottom. It's highly possible that a great deal of the good news now anticipated by consumers and economists has been anticipated first by the stock market. The "worst is over" bandwagon may well have already rolled past the reviewing stand. Piling into the market at this point is a bet that some as yet unimagined positive surprise is lurking around the corner -- and that no negative surprise is.

That's quite a bet, considering that:

- Mortgage rates have shot up more than half a point since the end of last month. Higher mortgage rates could strangle any housing market rebound in its cradle. Already, housing affordability is roughly back where it was in December, despite the continuing decline in home prices since then.

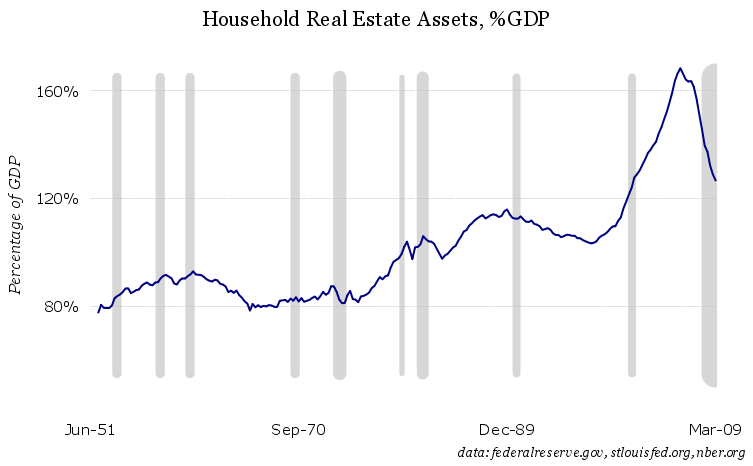

- Then there's this chart from data in the Fed's flow of funds report released on Thursday, with thanks to wcw@bignose.org and Felix Salmon. It underscores the possibility that housing is still not cheap. Compared to its historical relation to GDP, home prices could still have another, say, 30 percent to fall -- and that could further erode the value of banks' assets and seriously undercut all that encouraging consumer confidence.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.