Stock market "double-double": A reason for optimism

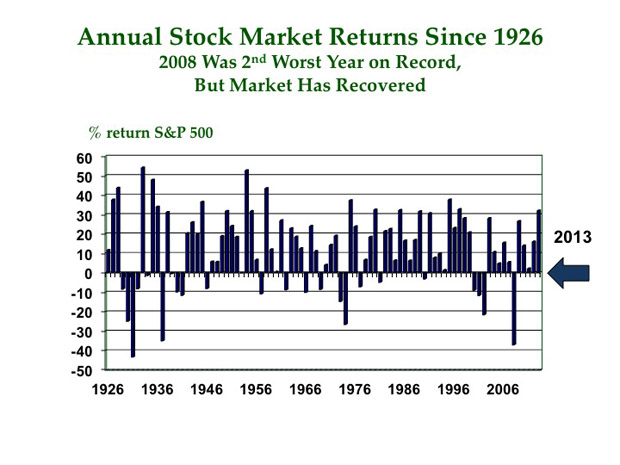

Each year I update a chart that shows the annual percentage returns in the S&P 500 for every year since 1926. This chart provides a good visual of what I call the "stock market double-double."

By the way, the returns shown here include both capital gains/losses and dividends.

If you look closely at the chart, you'll see that there are approximately twice as many up years as down; that's part one of the double-double. Here's part two: The up bars go up about twice as high as the down bars go down, meaning that when the market went up, you typically made much more money than you lost when the market went down.

Note that 2008 was the second-worst year on record. If you believed that the stock market would come back from its big drop in 2008-2009, and you suppressed the urge to panic and sell at the bottom of the market, you were rewarded with five years of positive returns in 2009, 2010, 2011, 2012 and 2013. The return for 2013 was a robust 32 percent, helped by the economy's recovery.

This chart also provides evidence that so far, we're not in the territory of the Great Depression. The worst year on record -- 1931 -- was preceded by two down years and was also followed by a down year. So far, 2008 has been followed by five up years.

For most of us, our retirement investing horizon gives us the time to ride out the downturns. It particularly helps if you build complementary sources of retirement security that aren't susceptible to market fluctuations, which I highly encourage you to do.

I'd also encourage you not to go whole hog and invest too much in stocks. A diversified portfolio of stocks, bonds, cash and possibly real estate has proven to provide adequate protection against the extremes of downturns and inflation while providing a return that should be sufficient to finance your retirement years. By the fall of 2011, many diversified portfolios recovered to exceed their pre-crash highs -- which is one reason for investing in a balanced portfolio. Actually, broader stock market indices such as the S&P 500 exceeded their pre-crash highs this year, which is more evidence for sticking with a long-term investing strategy.

Have the patience to let the stock market "double-double" work for you.

Steve Vernon

View all articles by Steve Vernon on CBS MoneyWatch»

Steve Vernon helped large employers design and manage their retirement programs for more than 35 years as a consulting actuary. Now he's a research scholar for the Stanford Center on Longevity, where he helps collect, direct and disseminate research that will improve the financial security of seniors. He's also president of Rest-of-Life Communications, delivers retirement planning workshops

and authored Retirement Game-Changers: Strategies for a Healthy, Financially Secure and Fulfilling Long Life and Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.