The 1% solution to saving $1 million for retirement

Saving money for retirement can feel overwhelming -- it's such a big chunk of money. But here's one smart strategy that's super manageable: making small increases each year in your savings rate.

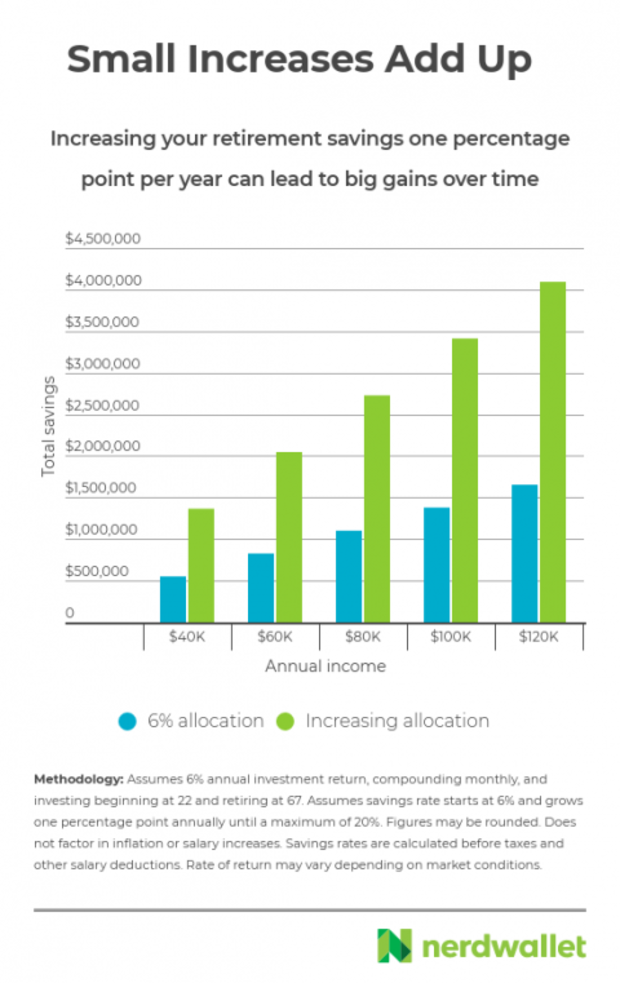

Say you're 22, earning $40,000 a year and saving 6 percent of your salary in an invested retirement account like a 401(k). If you stick with that same 6 percent savings rate year in and year out, you would end up with $551,000 by the time you're 67.

Upping the ante

But if you increased that 6 percent savings rate by just one percentage point every year, you'll end up with almost $1.4 million by the time you're 67. These figures assume you earn 6 percent on your investments and, if you hike your savings rate each year, you do so up to 20 percent but no higher.

Now let's say you're 22, earning $60,000 a year and saving 6 percent of your salary. Your nest egg will be $1.2 million larger if you increase your savings rate by one percentage point each year rather than keeping it at 6 percent. That is, your retirement savings account will be worth more than $2 million, instead of $827,000.

Check out the numbers based on different salary levels:

Finding the motivation

While 1 percent may not seem like much, you may still find it a struggle to diligently set aside that extra amount every year.

One mental trick: Take a moment to think about Future You, said Maura Griffin, a certified financial planner and founder of Blue Spark Capital Advisors in New York. As an easy reminder, do it every year on your birthday.

"Just say, 'This is my appointment with my future,'" she said.

It doesn't have to take long. Many workplace retirement plans offer an online account tool that makes it fairly simple to enroll -- and to adjust your contribution rate.

Tips for late starters

Our chart above assumes you've got 45 years to save. If you're in your 30s or older, that's unrealistic. (There's nothing stopping you from saving into your 70s, but you're probably going to want to start spending your retirement savings by that time.)

While the same principle holds for late starters -- the more you save, the more you'll have in retirement -- it's important for them to start at a higher savings rate.

Say you're 35, earning $60,000 a year and you've got zero retirement savings:

- If you start setting aside 10 percent of your salary into your 401(k) now, you'll have $731,000 when you retire at 67 (assuming you earn 6 percent on your investments and your employer doesn't offer a match).

- If, instead of 10 percent, you started saving 15 percent of your salary, you'd end up with $1.1 million.

- And if your employer does offer a match -- say, dollar-for-dollar up to 2 percent of your salary -- and on top of that you save 15 percent of your salary, you'll end up with $1.24 million by the time you're 67.

And these examples don't even factor in small savings increases every year. Want to run your own numbers? Check out a 401(k) calculator.

The takeaway? Wherever you're at, start saving now and increase your savings rate every year.

This article was written by NerdWallet and was originally published by Forbes.

More From NerdWallet

-

Check out our retirement calculator to see if you're on track

-

No 401(k)? See if a Roth or traditional IRA is best for you

-

Learn about simple investment portfolios to meet your retirement goals

- In:

- 401k

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.