Neither Boeing nor Airbus? Scoot gets Singapore's first Brazil-made jet off the ground

SINGAPORE - It was a rare moment in his 20 years of flying commercial aircraft.

As the Embraer E190-E2 plane touched down in Krabi, Thailand, after taking off from Changi Airport on May 7, Captain Darius Yeo was greeted with applause from passengers.

The 46-year-old, who is the pilot in charge of Scoot's new E190-E2 fleet, was at the controls of the budget carrier's first Brazilian-made jet on its maiden commercial flight.

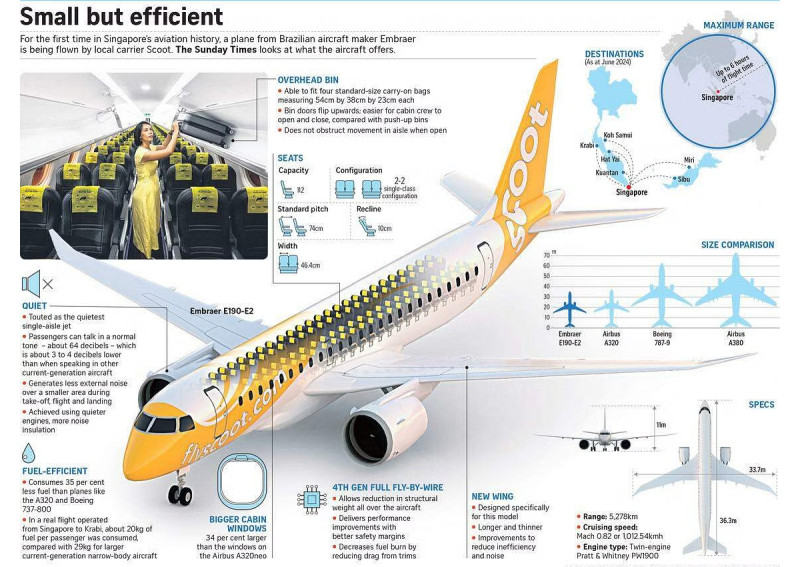

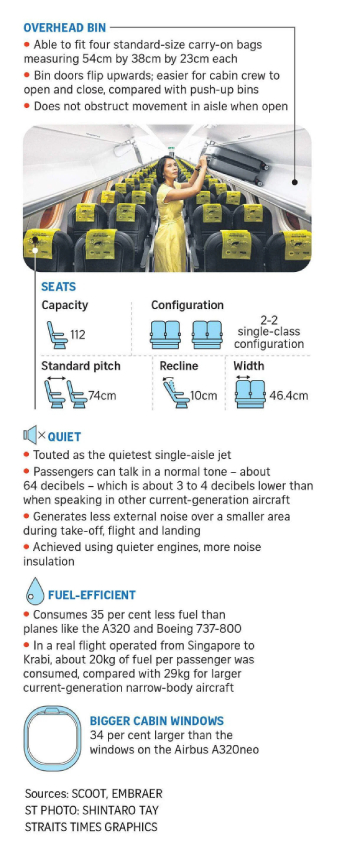

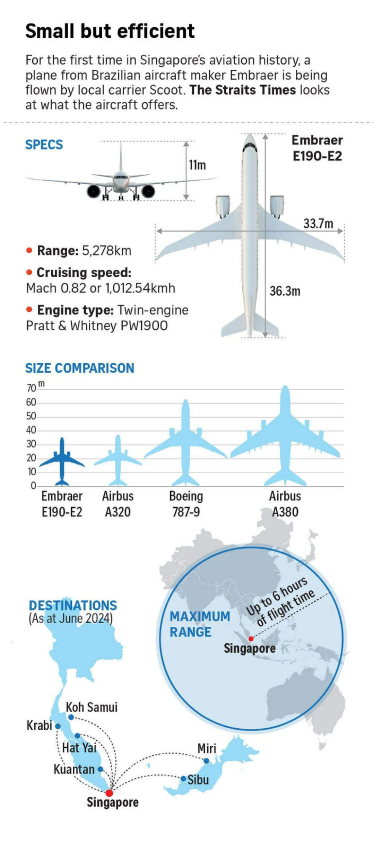

While the 112-seat plane is smaller than the Airbus A320, Boeing 777 and double-deck Airbus A380 "superjumbo" he previously flew, the flight was no less significant.

Made in Sao Jose dos Campos, a city in Brazil an hour from Sao Paulo, the E190-E2 is the first aircraft from manufacturer Embraer operated by a Singapore carrier.

It is also the first time since the late 1990s that a carrier in the Singapore Airlines (SIA) Group is flying a plane not supplied by Boeing or Airbus.

For passengers, the main benefit besides the novelty and added option is the absence of a middle seat.

Capt Yeo said the jet, touted as being the quietest in its class, has so far lived up to expectations.

"It is a very stable aircraft to fly and very responsive on the controls... The fuel burn we encountered is very good. It's nice to see that the numbers publicised by Embraer are up to the mark, if not slightly better."

Scoot has two E190-E2s in operation. Three more are due to arrive in the second half of 2024, and four will be delivered by end-2025. All nine aircraft are being leased from American firm Azorra.

Scoot has said the new aircraft will allow it to serve thinner and less popular routes in the region, fly to airports that cannot accommodate larger jets and increase frequencies on existing routes.

Initially, the planes will fly to six South-east Asian destinations, but Scoot has plans for more.

A plan born during Covid-19

While Scoot announced it was ordering the E190-E2s only in February 2023, plans to add a smaller plane to its fleet were hatched as early as 2022.

As Singapore eased Covid-19 pandemic travel restrictions, the budget carrier re-evaluated its network and began planning to bring in planes with about 100 seats. This was to complement its fleet of 21 Boeing 787s, which have more than 300 seats each, and 31 Airbus A320s and A321s, each having about 180 seats.

"The E190-E2 allows us to fly to destinations that may not be sustainable with the A320," Scoot chief executive Leslie Thng said in an earlier interview.

"We don't have to go beyond certain sales and marketing activities just to fill up the flight," he added.

He said another bonus is that the E190-E2s can mitigate some of the impact from a manufacturing flaw with Pratt & Whitney jet engines that has led to the grounding of three of Scoot's A320neos.

Azorra CEO John Evans said Scoot did a thorough analysis before approaching the market.

"(Scoot) really wanted something closer to 100 seats... They also preferred to lease because it is a new product for them."

In the fourth quarter of 2022, Scoot started a formal request for proposals. Mr Evans said its evaluation and selection process took about a year, and the carrier considered different proposals and funding options.

Neither Scoot nor Azorra was willing to disclose the specific terms of the leases, but Mr Evans said Scoot has the option to extend or cancel them early, subject to certain provisions.

"We brought (in) what I think both parties believe is an innovative solution to enable Scoot to launch this new initiative, without taking the same risks that come with ownership."

The parties involved in the talks described the negotiations as tough and comprehensive. Ultimately, several factors put the E190-E2s ahead of similar jets like the Airbus A220.

Scoot's planes come from Azorra's existing backlog with Embraer, and the Brazilian firm was able to deliver them in a shorter time than its competitors, said Mr Evans.

The low-cost carrier was also won over by the operational support that Embraer promised.

To sweeten the deal, the jet maker built up an inventory of US$100 million (S$135.5 million) in spare parts at its Singapore warehouse and agreed to invest in a new flight simulator here.

Mr Thng said: "It is key for us because our pilots will not have to travel out of Singapore to get their training."

Azorra's Mr Evans said South-east Asian airlines historically favoured bigger planes, but new investments in airport infrastructure and a change in travel patterns have changed that.

"Airlines also learnt during the pandemic that it's better to have an aircraft that can cover different demand cycles. So, if there are world events that impact air travel, they can still fly the smaller aircraft and better match capacity with demand," he added.

For Embraer, which has struggled to make significant inroads into South-east Asia, Scoot's order was a major breakthrough.

Mr Arjan Meijer, CEO of Embraer's commercial aviation division, said: "We believe that this step will really show the strength of the aircraft in this market."

Preparing for take-off

To get the E190-E2 in the air, Scoot worked closely with the Civil Aviation Authority of Singapore (CAAS) on safety and technical evaluations.

CAAS director for flight standards Alan Foo said it took 17 months for the authority to conduct the necessary due diligence to ensure Scoot could operate the new jet safely, and ensure the rest of the aviation ecosystem in Singapore could support it.

While CAAS engaged Embraer to ensure that the plane met airworthiness requirements, it also carried out a parallel process known as entry-into-service.

This entailed poring over documents and submissions, such as flying and maintenance manuals, safety training programmes and maintenance task schedules.

It also involved approving instructors to conduct training for cabin crew, and physical testing to certify the flight simulator that Embraer brought in.

Depending on the complexity, a new aircraft may take six to 18 months to enter service, Mr Foo said.

In the case of Scoot's Embraer jets, close collaboration with the airline, jet maker and Brazil's National Civil Aviation Agency sped up the process.

Meanwhile, Scoot had to train sufficient manpower. The first group of E190-E2 pilots came from Scoot's stable. There were also volunteers from SIA, mainly first officers, to help with the initial phase.

Scoot chief operating officer Ng Chee Keong said the carrier looked in-house as there is no ready pool of pilots with Embraer expertise in the region.

Training for the first batch of pilots started in February.

After finishing ground school, they each spent around 20 hours on the simulator over nine or 10 sessions, and then went on training flights supervised by Embraer instructors before being certified by CAAS to operate the new plane independently. The whole process usually takes 60 to 70 days.

Scoot said it has planned for a sufficient number of pilots to be trained to operate the E190-E2s. It declined to give exact figures, citing commercial considerations.

For cabin crew, Scoot said they can be trained to work on all three of its aircraft types, and the carrier brought in an E190-E2 door simulator so they can be trained here.

Mr Ng said engineers and technicians from Scoot, SIA and SIA Engineering Company have also been trained to work on the new plane. Other preparatory work included getting the ground handlers at Changi Airport and overseas airports ready for the Embraer jets.

To accommodate the E190-E2s, airport operator Changi Airport Group (CAG) conducted compatibility checks and made adjustments to the airport's systems and infrastructure. Familiarisation sessions and operational readiness trials were carried out.

Regional jets like the E190-E2, which are smaller aircraft used for short- to medium-haul flights, are currently permitted to operate only during Changi's non-peak runway hours. However, an exception has been made for at least one of Scoot's flights.

CAG spokesman Ivan Tan said regional jets can help to diversify Changi Airport's network in Asia, even though they have a lower seat capacity for every take-off and landing slot.

For instance, the Embraer jets could enable flights to places like Iloilo in the Philippines and Nha Trang in Vietnam, Mr Tan added.

Sticking the landing

While the E190-E2s have had a smooth start so far, with the inaugural flights to Krabi and Hat Yai almost selling out, there were some bumps along the way.

Like other aircraft manufacturers, Embraer has had to deal with supply chain snarls, and the delivery of Scoot's first jet was delayed from March to April due in part to the late delivery of components.

On the commercial front, it may not be all blue skies either.

Independent aviation analyst Brendan Sobie of Sobie Aviation said Scoot's two E190-E2s will boost the carrier's seat capacity by about 3.5 per cent.

He expects this to double by the end of 2024, and potentially quadruple when all nine Embraer planes are in service, though this will depend on the length of the routes.

However, he has doubts about the viability of some of Scoot's initial E190-E2 destinations. Except for Koh Samui, the other five routes are price-sensitive, with few high-paying passengers, he said.

Unattractive departure and arrival times late at night and early in the morning for some of the flights compound the issue.

"Consumers will love there is no middle seat, but they shouldn't expect lower fares," Mr Sobie said. "With smaller aircraft, the idea is to avoid selling the cheapest seats and achieve a higher average fare to offset the higher unit costs. On most secondary routes in South-east Asia, this is very difficult."

He added: "Keep in mind the high departure taxes from Changi Airport as well. On some of these routes, there is no way to attract passengers at fares much higher than the taxes."

According to Scoot's website, return tickets on Embraer flights to Krabi, Hat Yai, Sibu, Miri and Kuantan are being sold for as low as $120 to $150. For Koh Samui, it is $366 for a return trip.

Scoot's Mr Thng said the airline will have until 2026 to fully evaluate the E190-E2's performance.

"Yes, there are risks involved because it is an unknown fleet for us, and we are also chartering into many unknown territories by opening up more new points," he said. "But when we did the business case, we felt that it is strong enough for us to embark on this."

ALSO READ: Scoot hit by over 30 flight cancellations, cites 'operational reasons' for changes

This article was first published in The Straits Times. Permission required for reproduction.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.